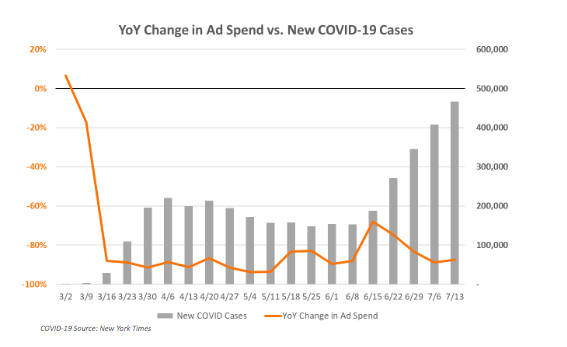

Consumer ad spending has had big swings this year.

Each industry has had a different response to COVID-19, but flexibility remains at the core of it all.

Let’s take a look at the ad spending most impacted by the latest rise in cases.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

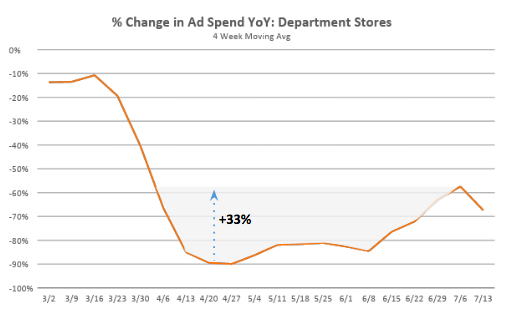

Department Stores

COVID-19 has devastated the department store industry.

“The mall has been losing ground for a long time,” explained retail consultant Jan Kniffen. “Now it’s losing ground faster.”

Prior to COVID, Kniffen expected about 33% of America’s malls to close by 2030. This pandemic has accelerated that trend and Kniffen now predicts that these closures will happen by next year. This will likely lead to the closure of roughly 13,000 retail stores.

We can see this major hit reflected in department store ad spending.

Ad spend from department stores plummeted about 90% year-over-year (YoY) early on in the pandemic. As the US softened business and social distancing restrictions, spending began to recover. However, with the rise in new case count, spending began to decline again.

Hair Care

The use of hair care products is tightly coupled to the progression of the pandemic. For example, Unilever reported that COVID-19 caused slumping sales in personal care items from brands like Dove.

“Consumers had fewer personal care occasions from going to work or socializing, and we saw a decline in our personal care business, except for hygiene products,” explained Unilever.

From March through May, ad spend from hair care products was down 29% YoY.

In June, when life seemed to have turned around, spending came back and was up 17% YoY. However, with retail and in-person activity slowing down, it returned to the March-May level.

Domestic and Regional Tourism

According to The Economist, Google search data reveals that travelers are interested in domestic travel for the remainder of 2020. Furthermore, they are favoring smaller attractions over large tourist destinations (i.e. Belfast instead of Barcelona, Orlando instead of NYC, etc.).

As cases seemed to be stagnating across the US, advertising for regional tourism was on the rise, peaking the week of June 15th.

However, since cases began to rise again, spend levels returned to near early pandemic lows.

Industries that increased ad spend with the rise of new cases

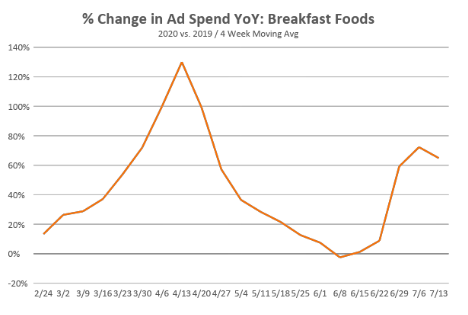

Breakfast Foods

Breakfast foods are tied to COVID-19 perhaps more than any other category. During the initial wave, as well as the recent surge, cereal brands drastically increased their ad spending to appeal to consumers eating quick and easy dried foods at home.

General Mills reported that their cereal sales in the US were up 26% YoY in Q2. They said they would be closely monitoring coronavirus and modifying strategy on the fly, which seems to be the case with their advertising.

At the height of shelter-in-place orders, ad spend was up roughly 130% YoY. It dropped as people began doing normal activities, but then rose again once cases began surging. The week of July 13th, ad spend was up more than 60% YoY.

Streaming Services

With people staying at home more, the number of hours spent streaming increased drastically. At the peak of shelter-in-place orders across the U.S., weekly consumption of streaming services rose by more than one billion hours.

Looking only at streaming services which were also available in Q1 2019, ad spend from this category is up 138% YoY since March began.

With the addition of Disney+, Peacock, HBO Max, Quibi, this category’s ad spend is up 284%.

COVID-19 is changing consumer habits—forcing advertisers to be very agile. We will continue to share the latest adjustments in media buying here.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.